Most teams already run on a CRM. Yet the warmest paths to new business rarely live there—they live in inboxes, calendars, LinkedIn connections, alumni threads, and people’s heads. That’s the gap relationship intelligence (RI) fills. It doesn’t replace your CRM; it reveals who knows who, surfaces warm introduction paths, and helps you prioritize the next best relationship move—then hands off outcomes to the CRM.

What CRMs Do Well (and Where They Struggle)

Pipeline tracking, forecasting, attribution

CRMs excel at representing your revenue engine: lead sources, stages, products, owners, expected close dates, and revenue. They’re built for predictability and governance—think standardized fields, required stages, dashboards for leadership, and integration with billing/CS tools. This is where you get forecast accuracy, historical performance, and compliance.

The gaps: hidden relationships, cross-team context, and intros

CRMs aren’t designed to discover relationships; they’re designed to record them. Three common pain points:

Hidden relationships: Your warmest paths—mentors, alumni, ex-colleagues, investors—rarely enter the CRM unless someone adds them manually.

Cross-team context: Call notes, decks, photos, mutual interests, and introductions often live in people’s inboxes or DMs, not on the account record.

Warm intros: CRMs don’t show who on your team knows the buyer best, or how to route a double-opt-in intro that actually gets a meeting.

What Relationship Intelligence Adds

A shared network graph: who knows who (and how well)

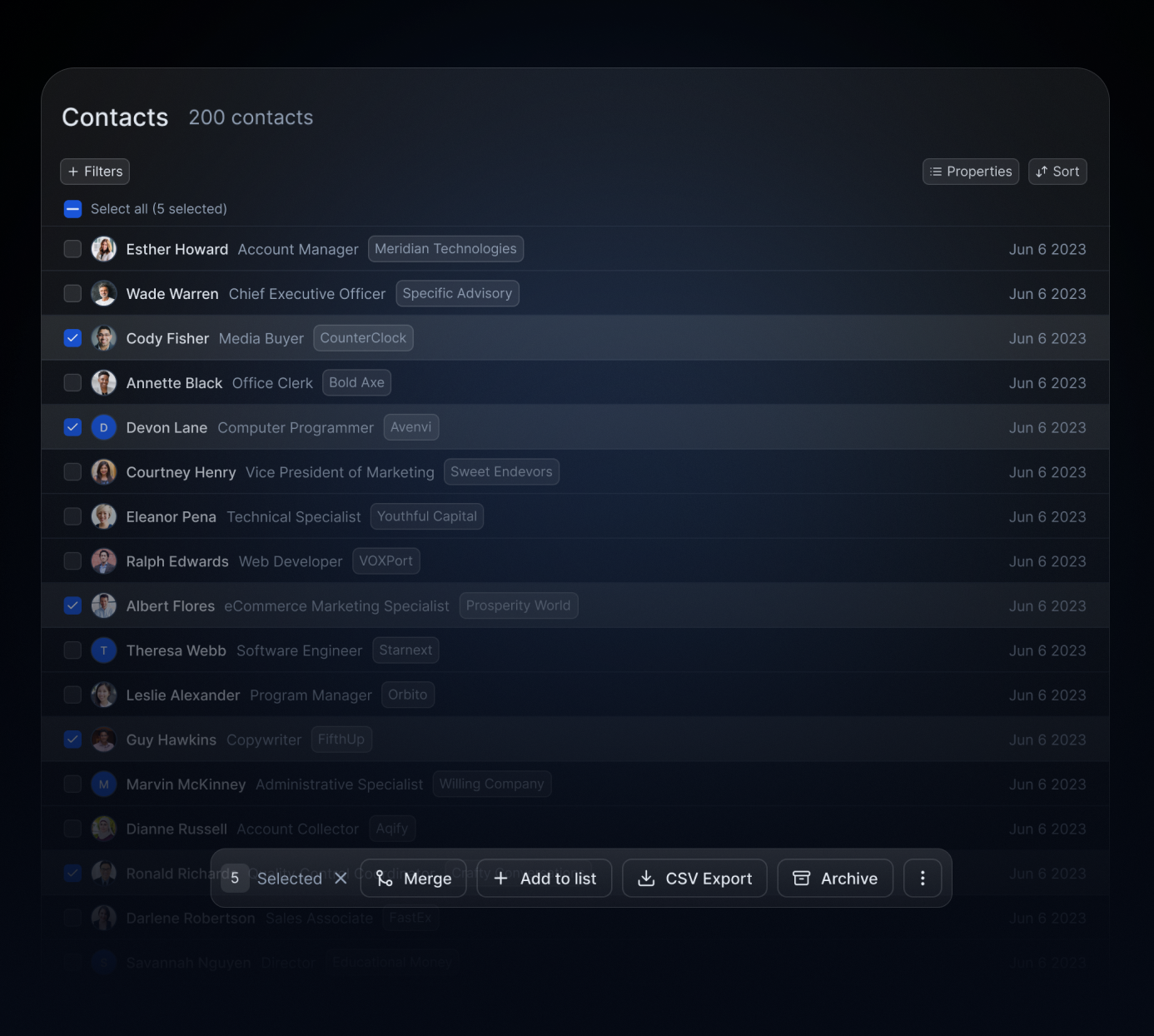

Relationship intelligence platforms (like Rolodex) pull signals from email, calendar, and LinkedIn to build a team-wide relationship graph. You see type of connection and tie strength (recency/frequency of interactions), not just static contact cards. Result: you can find the best human path into a target account in seconds.

Warm intro paths, org charts, keep-in-touch, title alerts

Warm paths:

Identify the colleague, advisor, or investor with the strongest tie to a prospect, then request a

double-opt-in

intro with a forwardable blurb.

Org charts:

Visualize stakeholders and reporting lines, then

multithread

with purpose—economic buyer, champion, security, legal, end users.

Keep-in-touch:

Set smart cadences that

auto-reset

after interactions so important relationships never go stale.

Title-change alerts:

Congratulate contacts at pivotal moments (new role, new company, promotion) and reopen conversations with timely value.

Data centered on people & companies—not just “deals”

Where CRMs index on deal stages, RI indexes on relationship momentum—who you’ve met, who owes a reply, who introduced whom, which accounts have warmth inside. You get a live picture of social proximity to targets and can act on it immediately.

When to Use Each (And Together)

Complementary stack patterns (RI → CRM)

A healthy GTM stack uses both, with a clean handoff:

Discover:

Use relationship intelligence to find warm paths into a target company and identify the right stakeholders.

Engage:

Request/intake intros, run outreach, log notes and attachments against people and companies (not just deals).

Convert & report:

When a real opportunity forms, create the opportunity in your CRM for pipeline tracking, forecasting, and revenue reporting.

Enrich & loop back:

Sync key outcomes (meetings booked, opportunity created/closed) so the RI layer can refine tie strength and momentum signals.

This keeps the CRM clean (real deals only) while giving the go-to-market team a working canvas to explore and activate the network.

Integration Checklist

Uni- or bi-directional sync:

Contacts/companies sync both ways; opportunities flow CRM → RI.

Ownership & permissions:

Respect visibility rules; execs can help without exposing private inboxes.

Activity ingestion:

Pull meetings/emails to score warmth and avoid double-logging.

Custom fields & tags:

Map roles (champion, EB), industry, segment, tier to both systems.

Source of truth:

CRM remains the revenue ledger; RI is the relationship insight/action layer.

ROI: From Cold to Warm Motions

Shifting even a portion of your prospecting from cold to warm changes the math:

Shorter sales cycles:

Warm intros compress the early trust-building steps—buyers take meetings faster when a credible mutual contact vouches.

Higher reply and meeting rates:

Social proof plus specificity (why you, why now) beats cold copy and generic sequences.

Better multithreading:

Org charts + warm paths help you navigate to the economic buyer and critical influencers earlier.

Improved expansion:

Title-change alerts and keep-in-touch cadences trigger timely check-ins that surface new projects and budgets.

Cleaner CRM hygiene:

Keep exploratory work out of pipeline until it’s real; once it’s real, hand off cleanly for forecasting and attribution.

Bottom line: CRMs help you count the business you’re likely to win. Relationship intelligence helps you create the business you otherwise wouldn’t.

FAQ

Is relationship intelligence a CRM replacement?

No. RI complements your CRM. Use RI to uncover and activate warm paths; use your CRM to track pipeline, forecast, and report revenue.

Where does the relationship data come from?

From team-approved sources like email, calendar, and LinkedIn connections—plus notes, attachments, and past meetings—consolidated into a shared network view.

How does this help non-sales teams?

Warm paths also drive recruiting, partnerships, fundraising, and executive outreach. Any team that benefits from “who knows who” benefits from RI.

What about privacy?

Use role-based permissions and private notes where needed. The goal is to share relationship signals that help the team, not to expose sensitive content.